While scouting the market for new games for the N3TWORK Platform, we’re always tracking the latest developments and innovations in the games space. And like just about everyone at the moment, we are captivated by the rise of NFTs and their potential to take mobile, free-to-play games to the next level. It’s not just Beeple’s record breaking auction at Christies or the multi-billion market capitalization of The Sandbox Game’s $SAND token. The incredible, mainstream success of Dapper Lab’s NBA Top Shot is, perhaps, the best proof of the powers of NFTs to drive a digital economy.

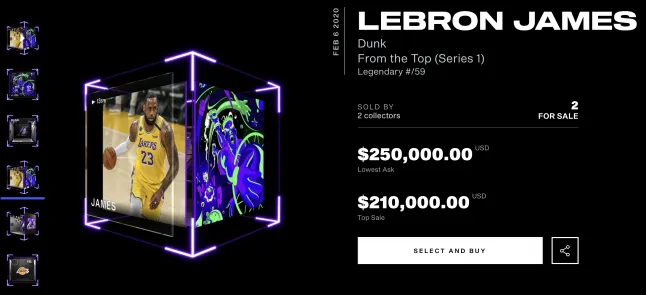

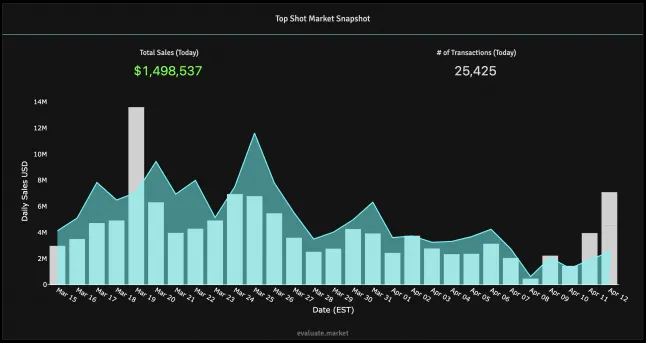

Top Shot’s meteoric ascent shows the power of NFTs to capture the imagination of a broad market segment. Just look at the $204 million worth of transactions on the platform, the eye popping $208,000 sale of a single Lebron James moment, and most recently, the massive $305 million investment round into Dapper Labs. I’ve been playing NBA Top Shot for the past month, and from a game developer perspective, NBA Top Shot feels just like any gacha based, event driven LiveOps game I’ve played or worked on. It is an incredibly fun and rewarding experience, but given my experience in LiveOps I can see that the road ahead for Dapper Labs is perilous. Like any digital economy, a few missteps or short term decisions on the part of the operator could lead to a total collapse of the market.

I’m sure this possibility is not lost on Dapper Labs, having built NBA Top Shot on top of the incredible boom and bust of the Crypto Kitties market. No doubt, they are in the best position possible to know the pitfalls of running an NFT economy, and are carefully managing their LiveOps calendar to ensure Top Shot’s long term success. However, I thought it would be interesting to think through 3 possible missteps that could lead to an irrevocable collapse of the NBA Top Shot economy.

Top Shot Explained

First, a primer on the “game” of NBA Top Shot for those who have not been joining Drops, collecting Moments, and buying and selling on the Marketplace these past few weeks.

At its simplest, NBA Top Shot is an officially licensed collectible card platform. Though not directly a game, it is a very gamified experience. Players collect Moments, short, video highlights of their favorite NBA players making incredible plays. Each Moment comes in a series and, depending on its type, can have either a fixed or growing issue. For example, you may collect a Limited Edition Moment from the current set that has a special type and trim with a fixed quantity. Each Moment has a serial number, so you may collect the #10 of #499 of a Legendary Tyler Hero dunk. Or a card may be part of a circulating issue, meaning that the final count of that card will continue to grow so long as that issue is in print. So you might get a common Kevin Durrant that is #24,768 in the issue of at least 35,000.

Each Moment is an NFT on Dapper Labs’s Flow blockchain platform. When you get a Moment, you are essentially getting a video clip with a certificate of authenticity attached. Similar to Beeple’s $69 million JPG, there is nothing preventing a non-owner from viewing someone else’s Moment and saving a copy of it to their hard drive, or displaying it on an iPad in their home. But only the owners of the Moment own a copy on the blockchain and have the ability to gift it to other players or sell it on the Marketplace.

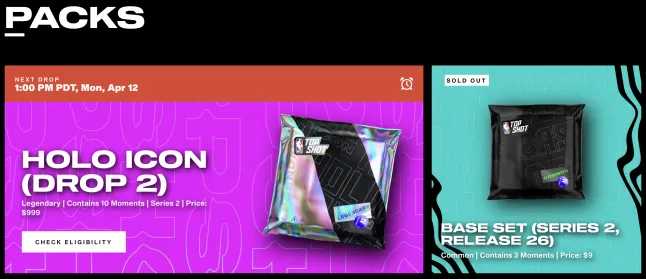

Moments are put into circulation in Drops. So far, these are roughly weekly releases of a limited or unlimited quantity of Packs for a fixed price. For example, the most expensive Pack I’ve tried to purchase is a $229 All-Star Pack that contained 7 Series 2 moments: a guaranteed All-Star Moment and 6 common Moments from Series 2. The least expensive was a $9 Series 2 Drop – this was an unlimited issue pre-order Pack with 3 common moments that as many players as wanted could purchase.

The method of selling Packs will sound familiar to anyone who’s ever waited in line for a limited edition sneaker release. Dapper will announce a new Drop via their email list, website, Discord and social networks. You might learn, for instance, that tomorrow at noon PST a Drop of 32,000 All-Star Packs will go on sale for $229, and that in order to purchase you need to own at least 3 Moments in your account. Before noon on the day of the drop, you join the queue, and when the clock strikes twelve all players in the queue are assigned a random position number. Those lucky players will get a low number and get the privilege of buying the limited issue Pack. But given Top Shot’s incredible popularity, you are more likely to get position 229,000 for an issue of only 32,000 packs, and know in an instant that you will not be able to purchase on that Drop’s pack.

There is a very liquid Marketplace for Moments where you can list any Moment in your collection at a price of your choosing. Any Moment that I have listed at or below the current lowest listing price has been snatched up in minutes. At the high end, I personally have sold a single Moment for nearly $1,600. At the low end, I’ve dumped some common Moments for a few dollars. When you sell a Moment, the cash goes into your Dapper balance, which you are able to withdraw to cash or use to purchase packs and Moments directly. Additionally, whenever you sell a card on the Marketplace, you pay a 5% transaction fee to Dapper Labs. Though some of this fee, I’m sure, is to cover the processing costs of all these blockchain transactions, sales on the Marketplace also generate profit for Dapper.

Though I have a very ROI positive account, I have yet to withdraw any cash yet, but not by choice. When you attempt to make your first withdrawal, you are told it will take some weeks to verify your account. Initially, Dapper promised to allow withdrawals within 30 days, but when I checked recently the estimate has increased to 6 to 8 weeks. So far, my credit card charges are real but my profits are theoretical.

In addition to buying Packs, or buying and selling on the Marketplace, you can also participate in limited-time Collection challenges. For example, you may have 2 weeks to collect 5 specific Moments. If you complete the Collection before time runs out, you are rewarded with a limited issue Moment that is not available in Drops.

All in all, you can see that the NBA Top Shot experience is very similar to any gacha based game. But instead of selling new heroes like we might in Legendary, Dapper Labs is issuing new Moments on a near weekly basis to sell in limited-time, limited quantity gacha packs at a variety of price points.

Spectators, Speculators and Superfans

In the past few weeks of playing the game of Top Shot and chatting about it with my friends, I’ve built a mental model with 3 player types that make up the Top Shot community. This model is important when thinking through various disaster scenarios for Dapper.

Spectators

One doesn’t have to put money on the line in order to participate in the “game” of Top Shot. Many players are simply Spectators, following the experience and talking about it with friends for fun. In the past month, I’ve had hours of conversation about Top Shot with other dad friends during socially-distanced playground dates and backyard BBQs. It has been a very popular topic of conversation. Whether you’re chatting about it with friends, watching Arda Öcal open a pack live on ESPN SportsNation, or reading this article, you are getting entertainment out of participating in Top Shot.

Most of my friends fall into this camp – having fun vicariously hearing about a big score in the latest Drop, but too skeptical of anything involving blockchain to put money down. In my model, these players are Spectators. This is where you start as a Top Shot player, and from here you may merely stay on the sidelines or graduate to become a Speculator or Superfan.

Speculators

Speculators are players who participate in Top Shot purely for the financial gain. They view Top Shot Moments as speculative investments, no different from buying stonks or purchasing Dogecoin and hoping Elon’s next tweet takes it to the moon. Spectators may or may not care about professional basketball. They might not even know who the players featured in the Moments they are buying and selling are. They are purchasing Packs because of the market heat and scarcity, and employing strategies ranging from immediately flipping their cards to long-term holds in the belief that Top Shot Moments are the new baseball cards and they’re getting in at the ground floor.

All of my friends who have graduated from Spectator fall into this camp. Whenever a pack drops, we all send screenshots of our new Moments to the one friend who follows the NBA to ask if we got anyone good. Most flip their moments immediately at the market price. A few brave players are holding out for long term value, but their confidence has quickly waned as they’ve watched the value of their portfolio drop in a few short weeks. Speculators are in it purely for the money. Given the high number of Speculators in the ecosystem, the strength of NBA Top Shot – its low friction, extremely liquid market – may also be its fatal weakness in the event of a market collapse.

Superfans

Superfans are the critical element to the long-term success of failure of NBA Top Shot and the inevitable imitators in other sports. A Superfan derives intrinsic value from their collection. When a Speculator buys a rare Lebron for $208,000, it is because they hope to someday sell that moment to another player at a healthy profit. When a Superfan buys that same card, it is because possessing it is worth $208,000 to them. Unlike a pure CCG like Magic where cards have utility that gives clear value to Superfans regardless of market value, NBA Top Shot moments have no utility. Their intrinsic value is based purely on what someone is willing to pay for them.

We know that NBA Superfans exist – they are the cornerstone of any collectible ecosystem. Only time will tell if enough Superfans will derive the same intrinsic value from owning blockchain based video clips as they do from owning pieces of cardboard with some ink printed on them.

Collapse Scenarios

Now that we understand the game of Top Shot and the archetypes playing the game, let’s look at some of the possible disaster scenarios that could lead to a market collapse.

An Abundance of Scarcity

With it’s near weekly drop schedule, Dapper Labs is putting new Moments into circulation all the time. Either multiple issues of commons from the current Series, or adding new Limited Edition issues. All-Stars, Cool Cats, Rising Stars, Seeing Stars, Etc. With each new limited issue set, they are releasing Moments of the same players again and again. As I write this, there are 14 different Steph Curry Moments available on the marketplace. At the high end is the LE Steph Curry Holo MMXX from Series 1. Of the 50 issued, 4 are currently listed for sale with the lowest asking price of $106,000. At the low end is the common card from the Base Set Series 2 with the lowest asking price of $25. The lowest price limited issue Steph is a the 2021 All Star card released just weeks ago with 2021 copies in circulation and an asking price of $640.

With it’s near weekly drop schedule, Dapper Labs is putting new Moments into circulation all the time. Either multiple issues of commons from the current Series, or adding new Limited Edition issues. All-Stars, Cool Cats, Rising Stars, Seeing Stars, Etc. With each new limited issue set, they are releasing Moments of the same players again and again. As I write this, there are 14 different Steph Curry Moments available on the marketplace. At the high end is the LE Steph Curry Holo MMXX from Series 1. Of the 50 issued, 4 are currently listed for sale with the lowest asking price of $106,000. At the low end is the common card from the Base Set Series 2 with the lowest asking price of $25. The lowest price limited issue Steph is a the 2021 All Star card released just weeks ago with 2021 copies in circulation and an asking price of $640.

The potential weakness highlighted here is that there is an abundance of scarcity. Although each individual limited edition Steph Moment is a rare object – ranging from 50 to 15,000 in circulation – there is already a large and growing number of scarce Steph Moments. If we fast forward two years, you could imagine there being 50 or 100 different “scarce” Steph Curry Moments. But with this great abundance of scarce objects, will Superfans truly value them as scarce and desirable collectibles? Or will each additional scarce Moment minted devalue not only that artifact, but all those that came before it.

Those gamedevs who have ever found themselves on the LiveOps treadmill of an event driven game will surely recognize this problem. In my opinion, the abundance of scarcity problem is Top Shot’s version of Power Creep. They need to keep feeding new, rare Moments to their players to keep up with demand for new Packs. You can imagine that the Speculators, who are currently setting the market price when they buy Moments from other players on the Marketplace, becoming indifferent to all these new issues, deciding en masse that new Series and new Limited Edition sets are not worth shelling out hundreds of dollars for when they miss out on a Drop.

This is one way the market could collapse. The illusion of scarcity and therefore value continuously erodes as a side effect of the Power Creep from releasing new Moments week after week. Next July’s theoretical Top Dogs LE Moment’s do not command the premiums that previous issues do, and earning an instant profit on a hundred dollar Pack is no longer guaranteed. High end Speculators, who have set the high prices when buying up Moments from other players, decide to take their money and run. With each Speculator that decides to cash out, the lowest asking price for even the rarest Moments drop. This creates not a sudden burst, but a slow, steady market deflation. Eventually the liquidity of the market dries up when only Superfans are left to buy up those Moments they personally value on the Marketplace.

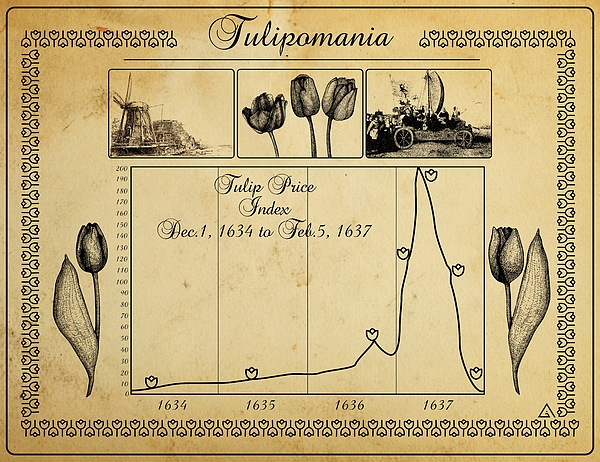

Market Panic

Whenever I first explain Top Shot to a friend or family member, one of two historical bubbles comes up. If they are an economics geek like me, then they bring up Tulip Mania. But in my age group, an explanation of NBA Top Shot invariably leads to reminiscing about Beanie Babies. Everyone seems to have gotten caught up in the Beanie Baby fad and many still have a box of pristine Beanie Babies with their tags still on somewhere around the house. “At least those were physical objects, these Moments are just video clips? Someone paid $200,000 for a Youtube video of Lebron dunking?” they ask incredulously. Then when I explain that they could go watch that Moment right now, download it to their computer, even display it in their home if they wanted to, it confirms the Spectator’s suspicion that this is just the next, dumb fad and that the bubble will surely burst any day now.

As I said, the great strength of NBA Top Shot – it’s low friction, highly liquid market – could easily become its downfall. It’s easy to imagine any number of events triggering a market panic. Perhaps stories about Top Shot being a scam go viral. Perhaps there is a well organized boycott of new Packs driven by Discord groups. Perhaps there is the threat of impending government regulation, or a scandal involving Dapper employees making millions selling supposedly rare Moments. Perhaps I trigger a panic by tweeting about how glad I am that the moment I sold for $1600 is now listing for under $500. Perhaps it’s purely random herd momentum. It’s easy to imagine the Top Shot bubble bursting with no discernable root cause.

This is a second way the market could collapse. A panic that feeds on itself. This is similar to the first scenario, but happening suddenly in a few days or weeks, not slowly over months and months. The Top Shot economy, inflated by the enthusiasm of Speculators, is burst by those same Speculators fearing that they will lose all their paper gains. A headline about a player seeing tens of thousands of dollars of value disappear overnight spurs more and more players to liquidate their accounts. Spectators leave en masse, leaving only those true Superfans behind, who correct the market to prices that reflect the value of ownership stripped of the promise of getting rich quick. All those friends who predicted that Moments are just digital Beanie Babies will go to sleep happy they avoided throwing their money away on an obvious fad.

Failures and Friction

As I’ve been playing Top Shot for the past few weeks, I’ve encountered technical issues on a regular basis. None catastrophic, but each an annoying point of friction. Sometimes I’ll try to list or buy a Moment and the transaction will fail. One such technical failure cost me $100 as I attempted to list a newly acquired moment, had the listing fail, got locked out of listing another Moment for 30 minutes and watched the price plummet before my eyes. The Marketplace is turned off regularly, and it is common for a Drop to be pushed back several times in a day or postponed indefinitely as they work through technical issues.

Most frustratingly, I have been unable to get my Dapper account enabled for withdrawals. The estimated time for this has recently increased from 30 days to 6 to 8 weeks. One friend – a skeptical Speculator – emailed me an exchange with customer service saying there’s nothing they can do about the 8 week delay as I wrote this post. He has gone on a Pack boycott until he sees money in his bank account and can confirm this isn’t some sort of scam. Like many Speculators, he is wary that Top Shot is a fad and is determined not to be the sucker with an account full of worthless Moments.

None of these issues are surprising given the newness of the Flow blockchain platform powering Top Shot, or its explosive growth. And most likely, players will push through the failures and friction due to the promise of easy riches. However, one could imagine that these regular technical issues could have the dual effect of turning low commitment Speculators away from Top Shot while also reversing the incredible word of mouth fueling its growth. Instead of enthusiastic Speculators encouraging Spectators to join the market, you have frustrated Speculators feeling they’ve gotten ripped off, warning their friends to avoid Top Shot all together.

I’m not saying Top Shot is a pyramid scheme, but it is possible that it is operating like one, with the incredible transaction volume on the Marketplace driven by a constant influx of new Speculators with open wallets and hearts full of FOMO. If this is the case, it is easy to see how technical failures and friction could create a market collapse. If prices are being propped up by new users, and if the new users dry up so will the money being pumped into the system. Speculators will be forced to sell to each other, and as they lose faith in the value of their assets, they will lower their listing prices to move their Moments. Prices will drop and drop until they reach a new equilibrium, and it will be clear that the free money phase of Top Shot has ended.

Long Term Prospects

None of this is to say that I’m predicting that NBA Top Shot is a bubble waiting to burst. The point I am making is that if you view Top Shot as a game economy, you can see that Dapper Labs is in an incredibly precarious position. Having lived through the boom and bust of CryptoKitties, perhaps no company is better prepared to successfully manage the Top Shot economy than Dapper. But you can see how difficult their LiveOps management challenge is, and some of the many ways that their business could evaporate before their very eyes.

But regardless of the long term prospects of NBA Top Shot, or whether they are able to replicate the success through their partnerships with UFC, Dr. Seuss, and Warner Music, Dapper has not only done incredible business with Top Shot, but more importantly built a blockchain platform in Flow that is certain to create long term value for Dapper and their investors.

And in the broader games space, I feel that we are just starting to scratch the surface of what NFTs can bring to free-to-play games. If I fast forward a year or two, I fully expect NFTs to be a feature of the digital economy for many games submitted to the N3TWORK Platform. Though there are sure to be countless failed experiments along the way, it is inevitable that we will see a billion dollar free-to-play mobile game built from the ground up around NFTs in a way that authentically enhances the game for players.